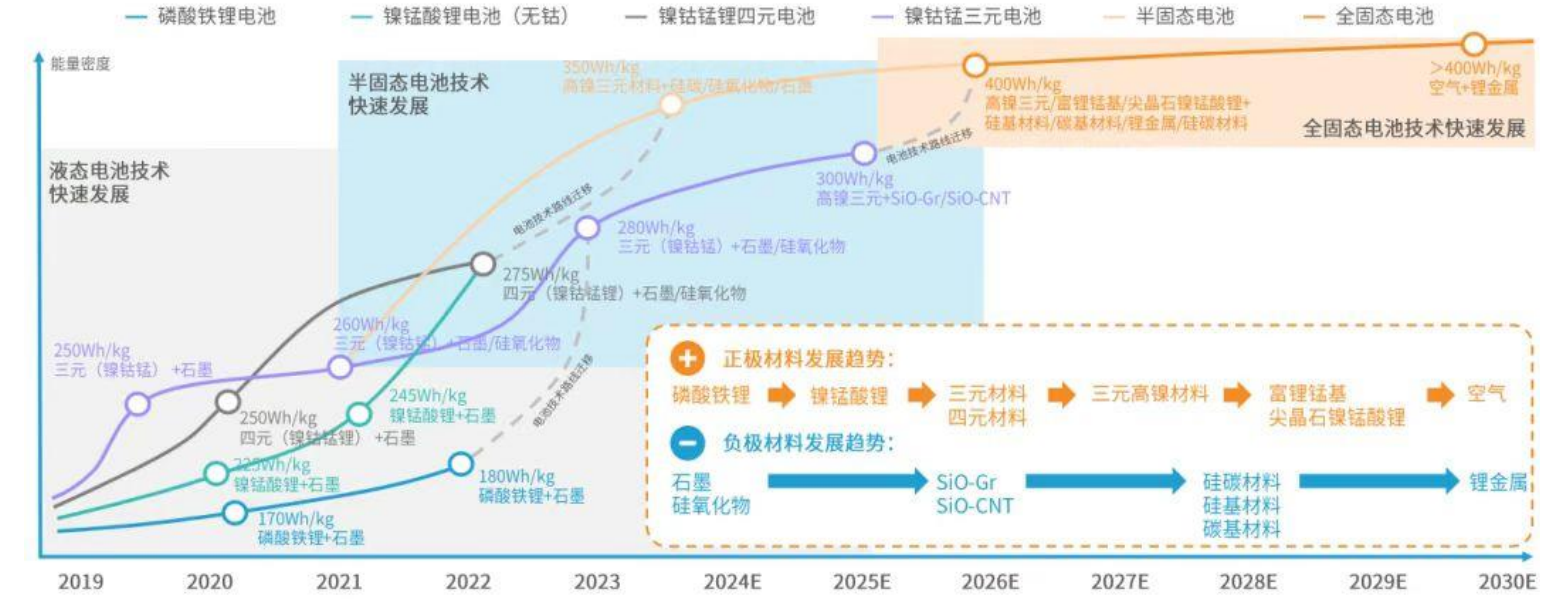

New technologies: Solid-state batteries, silicon anodes, and sodium batteries are expected to achieve industrialization.

1.CVD silicon anode

The large-scale production capacity of CVD silicon anode is expected to be gradually implemented in 2025-2026, with costs expected to decline, promoting its application in power batteries. We are optimistic about the finished product manufacturing and porous carbon segments. The solid-state battery arms race is ongoing. In 2027, domestic subsidies will facilitate small-scale batch installation. We are optimistic about dry electrode equipment, sulfides, and zirconium elements. The equipment and processes for composite current collectors are continuously being optimized, with significant potential for cost reduction in the long term. We expect large-scale production in the second half of 2025 and are optimistic about the equipment and manufacturing segments. Sodium batteries have unique advantages such as low-temperature performance. They are expected to gradually reach parity with iron lithium batteries over the next three years and are likely to see further growth in 2025. We are optimistic about the positive and negative electrode hard carbon segments.

2. Solid-state batteries

Industrialization pace: With subsidies from the Ministry of Industry and Information Technology in China, it is expected that small-scale vehicle installations will be possible by 2027. Leading overseas companies such as Toyota are projected to commence small-scale production between 2026 and 2027. On May 29th, China.org.cn reported that China may invest approximately 6 billion yuan to encourage qualified enterprises to conduct research and development on related technologies of all-solid-state batteries, accelerating the industrialization of solid-state batteries in the country.

Technical route: The all-solid-state routes of sulfides and halides hold the most promise, while oxide semi-solid-state has already entered mass production. In terms of performance, sulfides and halides have the best electrical conductivity and flexibility, making them ideal materials for all-solid-state batteries. Oxides are more suitable for semi-solid-state and have achieved relatively mature applications, with some already installed in vehicles.

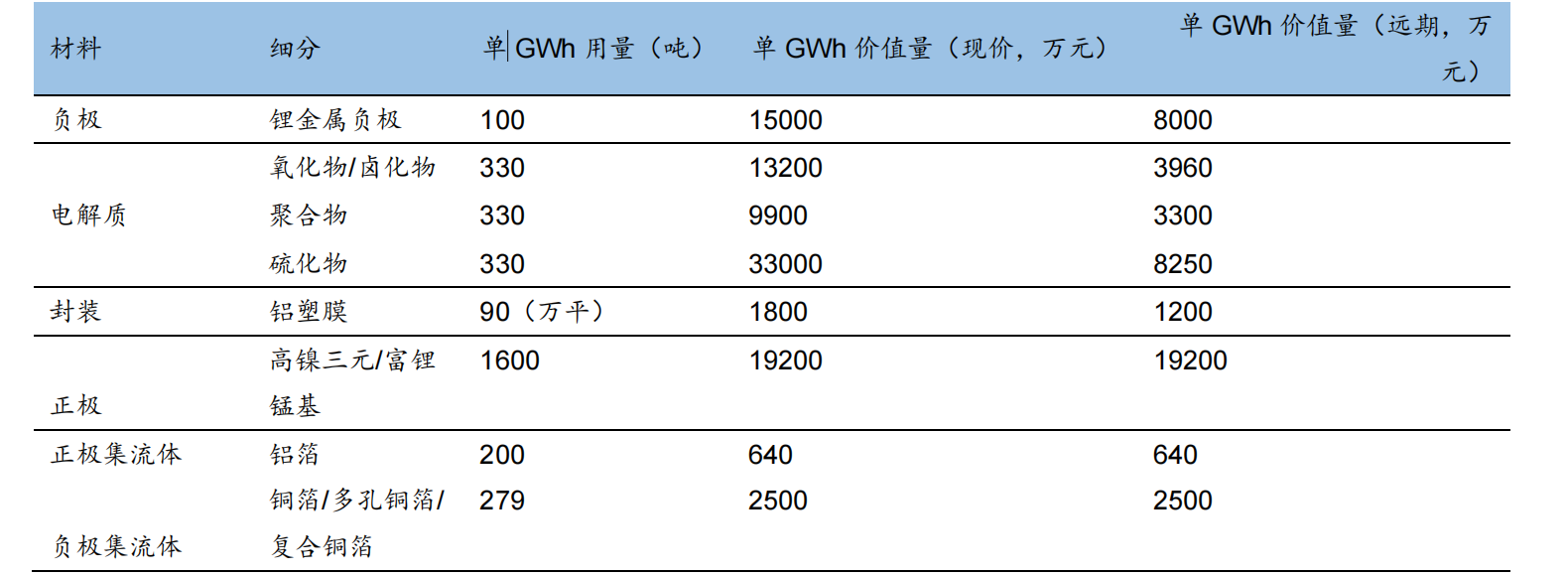

The supply chain: negative electrode, electrolyte, and dry electrode equipment are at the core. From the perspective of the long-term value of each raw material for solid-state batteries, we calculate that the value of the positive electrode is the highest, with a value of 190 million yuan per GWh. Next is the sulfide electrolyte, with a value of 82.5 million yuan per GWh. If the oxide or polymer route is used, the value of the electrolyte per GWh is 39.6 million yuan and 33 million yuan respectively. The value of dry electrode equipment per GWh is 25-30 million yuan.

3. Sodium Batteries

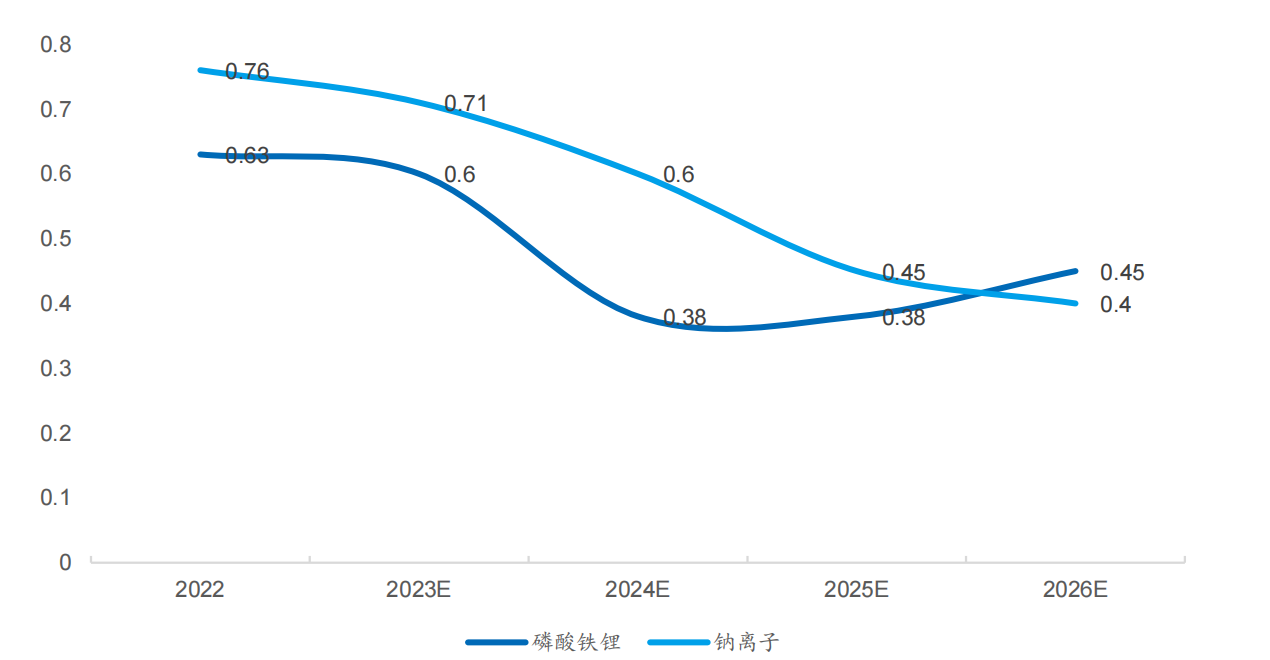

Sodium batteries are expected to reach price parity with lithium batteries within the next three years and outperform lithium batteries in some application scenarios. Sodium batteries have advantages such as low cost, excellent stability at high and low temperatures, and good rate performance.

1) Sodium resources are abundant, widely distributed, and low-cost, with no development bottlenecks.

2) Sodium-ion batteries have excellent rate performance and high and low-temperature performance.

3) Sodium-ion batteries do not catch fire or explode in safety tests, demonstrating good safety performance. It is expected that sodium batteries will achieve price parity with lithium batteries by 2026.

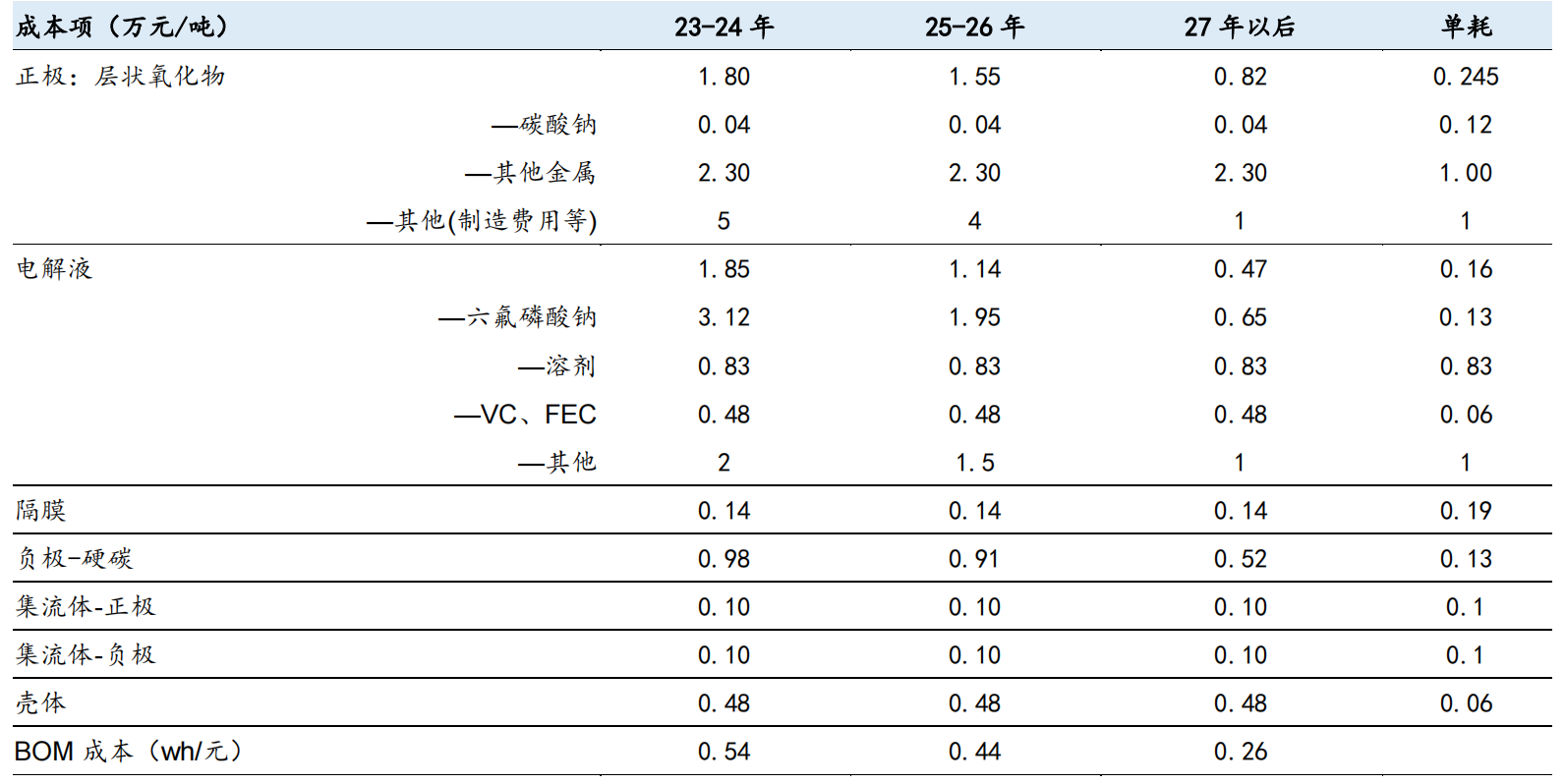

Supply Chain: The manufacturing process of sodium batteries is similar to that of lithium batteries, with the core being the additional raw materials. The main marginal increments are hard carbon and cathodes.

Content source: Cinda Securities

[Disclaimer] The content of this article is sourced from the "New Energy Era" WeChat official account.